- calendar_month March 20, 2023

The national housing market is entering an era marked by what’s absent — one that looks neither like pre-pandemic times nor the frenzied pace of the last few years.

“This new normal will be one with far fewer listings and lower inventory than we’re used to,” says Zillow Senior Economist Nicole Bachaud. “But also without the kind of intense demand that was fueling the market during 2020 and through 2022.”

Another thing that’s missing now and for the foreseeable future: low mortgage rates. It isn’t clear when rates will fall substantially again. The uncertainty poses challenges for both buyers and sellers.

To get an idea of how the spring home buying and selling season may look, we spoke with Zillow economists Jeff Tucker and Nicole Bachaud.

Sellers may face less competition now than in a few months

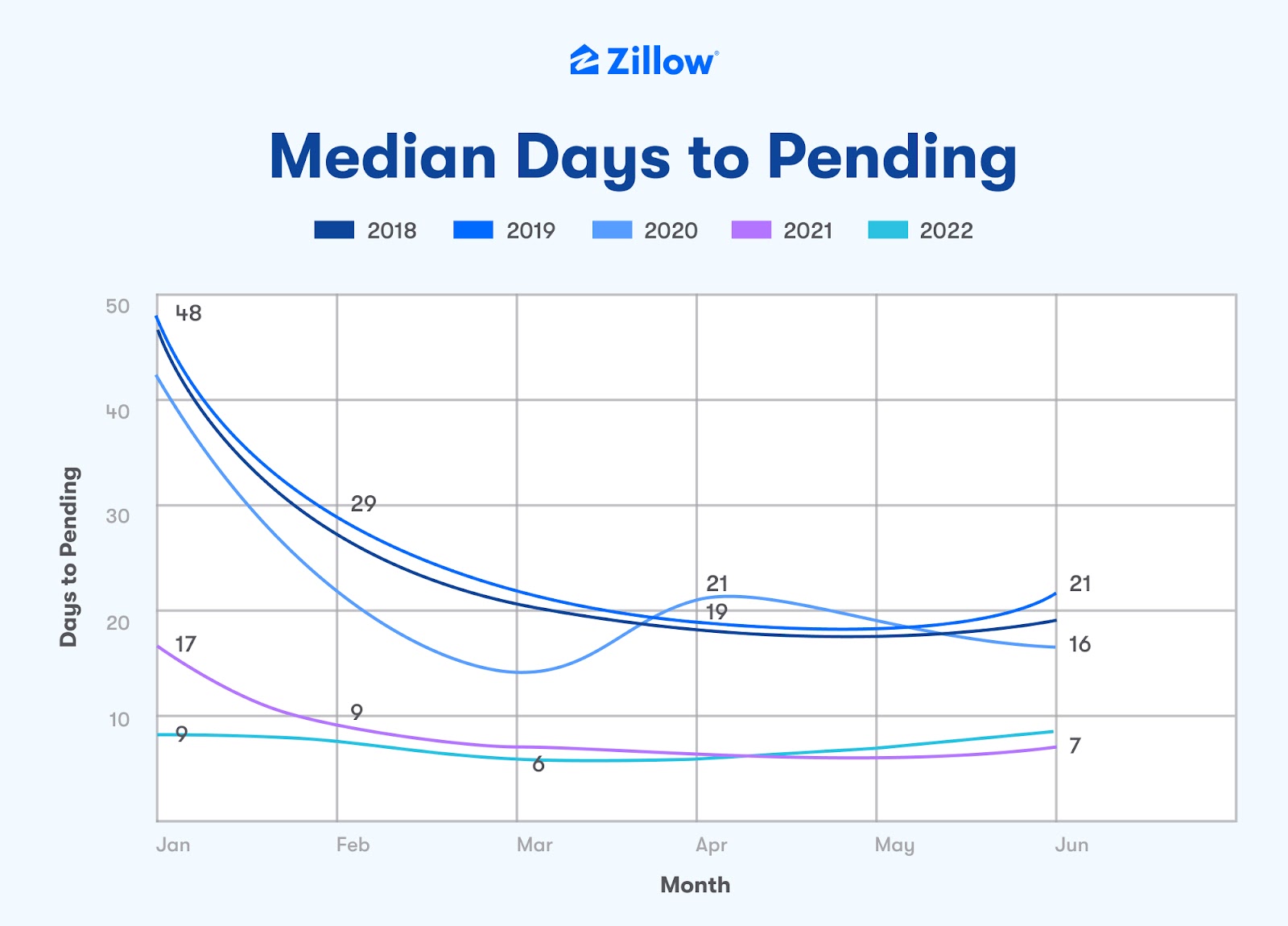

Key stat: At 31 days, median time on market in January was slower than the last two years, but faster than pre-pandemic norms.

While pending sales volume this winter has been strong enough to indicate a buyer comeback, many homeowners are still hesitating to list. The risk for sellers waiting until April or May is that no one knows what mortgage rates will do in the meantime.

“Homeowners who list a home sooner than later this spring will find their open house looks like an oasis for frustrated home buyers who have nearly record-few listings to choose from at the moment,” Tucker says. “Conventional wisdom says that sale prices may be a little higher in April, but the unusual paucity of listings this spring means that sellers today face little competition from homes down the block.”

In recent years, home shopping activity has surged in the spring, driving down the time it takes for the median listing to go pending. New listings flood the market as well, so the earlier a seller lists, the less competition that listing will likely see.

Takeaway: According to Tucker, “This is already by far the best time to list a home for sale in several months, and there’s no telling what the middle and later phases of the traditional spring selling season will look like.”

National home values aren’t expected to rise or fall significantly in the next year

Key stat: Zillow’s projected January 2024 typical home value: $331,650 — a difference of less than one percentage point from where we were January 2023.

January 2023’s typical home value came in at $329,542. Even if there are modest increases in the spring and summer, Zillow economists predict home values will level off by the start of next year. Also, those price increases will likely come alongside more buyer competition.

Takeaway: Buyers on the fence may not have many convincing reasons to wait. And the offseason likely won’t bring much price relief compared to now.

An abundance of new construction homes is coming online

Key stat: An estimated 439,000 new construction houses were for sale at the end of January, a supply of eight months at the current sales rate.

Some good news: “Permits and starts for new construction boomed during the pandemic, and they’re finally getting completed,” Bachaud says. “That supply of new construction homes can be really helpful for buyers, especially because a lot of builders right now are offering incentives like rate buydowns. Working with new construction might be a really great way for buyers to get their foot in the door of this market.”

Grant Brissey

Zillow