- calendar_month April 19, 2023

In this article:

- Types of first-time home buyer programs

- Down payment assistance

- Grants

- Penalty-free IRA withdrawal

- Closing costs assistance

- Discounts

- Interest reduction programs for buyers

- First-time home buyer loans

- State and local programs

- Loan programs for Native Americans

The process of buying a home for the first time can be overwhelming — from finding a place that’s the right fit for you to saving up for a down payment, budgeting for closing costs and everything in between. When it comes to figuring out your financing options, you don’t have to do all the heavy-lifting alone — in fact, out of the 45 percent of home buyers who are purchasing a home for the first time, less than half say they saved the majority of their down payments themselves, according to the Zillow Consumer Housing Trends Report. There are a wide range of resources to help you fund your down payment and ultimately get home, whether it’s a grant designed to help reduce upfront home buying costs, lender credits, or a loan that offers more flexible qualifying guidelines.

If you haven’t already, consider getting pre-qualified so that you can have a clearer picture on how much you may be able to afford, with your down payment taken into account. This won’t affect your credit score and doesn’t commit you to working with a lender. Then, conduct some research on your own or work with a mortgage professional so that you’re familiar with the specific first-time home buyer programs or grants available in your area. Here’s an overview of some options to get started.

Types of first-time home buyer programs

Note that most first-time home buyer programs target buyers who have not owned a home in the last three years. So, even if you’ve owned a home in the past, one of these buyer programs or grants could apply to you.

Down payment assistance

Programs designed for down payment assistance are typically reserved for first-time buyers who are acquiring a loan for their primary home. These programs typically work in conjunction with loan programs such as those offered by the FHA, VA, USDA, Fannie Mae and Freddie Mac (more on first-time buyer loan options later).

If you qualify for a down payment assistance program, your state or local municipality will distribute funds, most commonly in the form of a second mortgage. These loans are often interest-free, and sometimes, the loan will include deferred payments — to be repaid at the time you resell your home or pay off your mortgage (including if you decide to refinance). Other down payment assistance programs are lump-sum grants that you do not need to pay back.

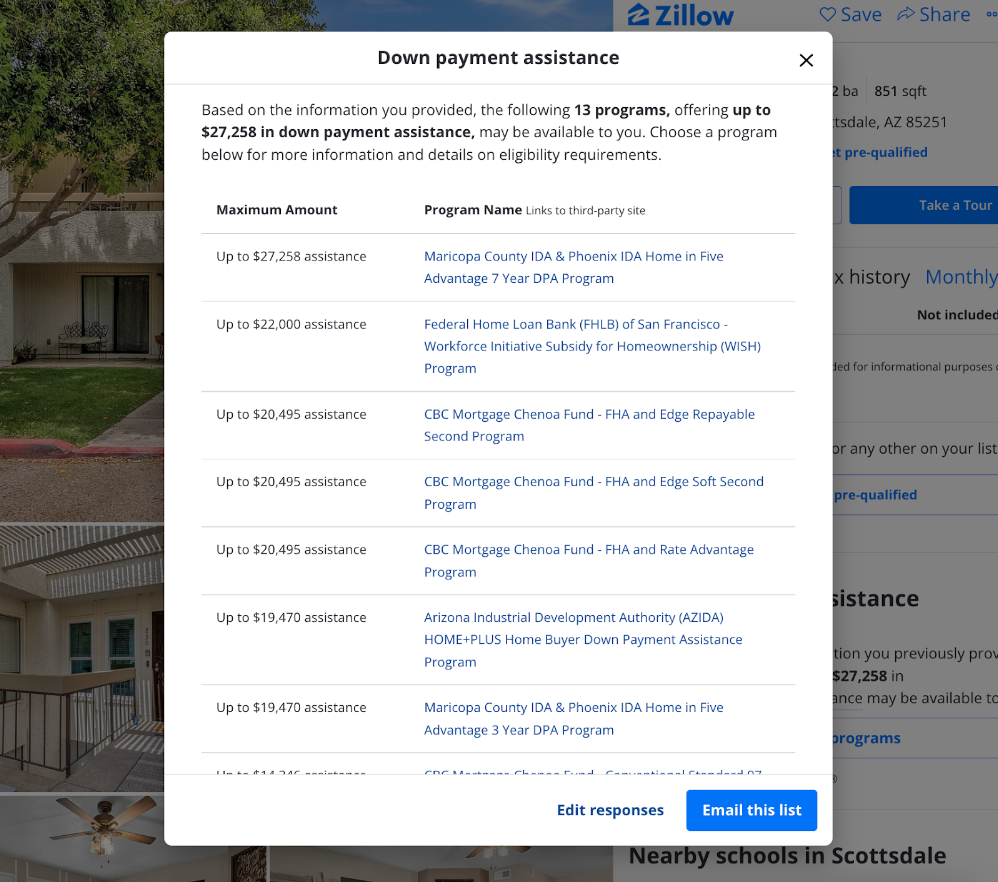

Today, you can use Zillow’s down payment assistance page and questionnaire tool to surface assistance funds and programs you may qualify for. You can also view down payment assistance programs on Zillow listings. Simply scroll to the down payment assistance tool on a home listing you’re interested in and click “enter your information”, where you’ll receive a prompt to answer up to six questions to customize your results. Once you submit your responses, you’ll get a list of down payment assistance programs you may be eligible for at the address.

Benefits: Upfront cash for your down payment, with deferred repayment and little or no interest. Note, every down payment program has different requirements and offerings.

Limits: There are income restrictions, and assistance is only available with an approved loan program. Funds are generally distributed as a second loan, and not all are offered at 0 percent interest.

Grants

First-time home buyer grants are typically given in the form of a lump-sum payment that does not need to be repaid. You can apply a grant toward closing fees or your down payment to help reduce your total home buying costs. The grant does not cover the full purchase amount of your home. Keep in mind that some grants are given in the form of a low-interest loan with deferred repayment, meaning you’ll need to pay the money back later — often when you resell your home. Most grants have income, profession and/or neighborhood restrictions in order to qualify, in addition to the first-time home buyer requirement.

The federal government gives funds to states and other municipalities to distribute locally with guidelines around first-time ownership and home buyer education. Some cities offer substantial first home buyer grants that primarily target lower-income buyers. These grants are often available for buyers in specific professions — like teaching or firefighting — or people who are buying in specific neighborhoods. Several nonprofits also offer grants to help first-time home buyers.

Benefits: Cash you do not have to pay back immediately, if at all.

Limits: Possible income limits, profession limits or neighborhood restrictions. Some grants are offered as an interest-bearing loan that you are required to pay back when you resell the home.

Penalty-free IRA withdrawal

One option that is available exclusively to first-time home buyers is the ability to take a penalty-free withdrawal from an IRA or Roth IRA to make a down payment. In other words, you can use cash from your retirement account to help with your home purchase. In this case, the IRS defines a first-time buyer as someone who has not owned their primary residence in the past two years. You’re still responsible for unpaid income tax on the amounts withdrawn, and there are maximum withdrawal limits. Before electing any IRA withdrawal option, talk to a tax professional about the implications of your choice.

Traditional IRA withdrawal

You can withdraw up to $10,000 from a traditional IRA to make a down payment on your first home. You will pay income tax on that money, but you won’t have to pay the 10 percent early-withdrawal penalty.

Roth IRA withdrawal

With a Roth IRA, things are a bit more complicated. But, assuming the IRA has been open for at least five years and you don’t take out more than $10,000 worth of earnings, the withdrawal should be tax- and penalty-free. Please consult a tax professional for more details.

Benefits: Tap into your savings without a penalty fee.

Limits: There are withdrawal limits, and there may be tax implications. There is always some risk when diverting funds from a retirement plan.

Closing costs assistance

First-time home buyers can qualify for programs that reduce closing costs. The majority of these fees are the fees that are paid at closing, when the property title is transferred to the buyer. Closing costs fluctuate based on your area, the type of home you buy and the type of loan you get, and sellers may agree to cover some of these costs. Common closing costs include closing or escrow fees, title fees, appraisal fees, HOA transfer fees, survey fees, attorney fees and courier fees.

Discounts

First-time home buyers can save money on their purchase through programs that offer discounts on or toward the property itself. Savings can be substantial through these programs, which are available through the U.S. Department of Housing and Urban Development (HUD). Some of these HUD discount programs include the Good Neighbor Next Door program that takes 50 percent off a home’s listed price, Energy Efficient Mortgage Loans that help homeowners finance improvements to save on future energy costs, and Homeownership Vouchers that can be used toward the purchase of a home. However, each program has specific buyer (and often, property) eligibility.

Homeownership vouchers

The Housing Choice Voucher homeowner program is another discount that is available via HUD. This program provides subsidies for home buying by allowing buyers to use vouchers toward the purchase of a property. This program is restricted to first-time home buyers who currently receive public housing assistance, along with those who meet low-income requirements. For more information, contact your local Public Housing Agency (PHA).

Benefits: Qualified first-time home buyers can use Housing Choice Vouchers as payment toward a residence and may receive monthly assistance for certain homeownership expenses. Some PHAs may offer an assistance grant for down payments; this is highly dependent on the agency.

Limits: Those accepted into the program may need to meet certain income and employment requirements. Pre-assistance homeownership and housing counseling programs may need to be completed as well.

Good Neighbor Next Door program

If you’re a teacher (pre-kindergarten through 12th grade), firefighter, law enforcement officer or emergency medical technician, you are considered a “Good Neighbor” for the purposes of HUD’s Good Neighbor Next Door program. Designed to connect qualified buyers in these professions to single-family homes in targeted revitalization areas — all in the name of community revitalization — the Good Neighbor Next Door program offers a 50 percent discount off the home sales price. The property must be located in a specifically designated revitalization area (you can find eligible properties by searching the HUD Homes website).

Once listed, a property is only available for purchase for seven days; available listings are updated weekly. Buyers must also agree to live in the home as their principal residence for 36 months.

Benefits: Qualified buyers may benefit from a lower down payment as a result of the reduced sales price.

Limits: If more than one buyer is interested in a home, a lottery is held to determine who can submit an offer. Additionally, approved buyers must sign a second mortgage and promissory note in the amount of the discount. However, interest and payments are not required if the 36-month occupancy requirement is met.

Energy Efficient Mortgage (EEM) loan

Available through HUD, the Energy Efficient Mortgage program enables first-time home buyers to access cash to implement energy efficient home improvements that lead to lower energy costs. First, buyers must qualify for a Federal Housing Association (FHA) backed mortgage for the purchase of a principal residence. Then, the costs of the energy efficient improvements are added to the total loan. Note that borrowers only need to qualify for the amount of the loan used to purchase the home, not the total loan amount.

Benefits: Home buyers can access more money to make improvements through their mortgage without having to provide more money upfront to qualify for the increased amount. Future energy bills will be lower than they would be if upgrades hadn’t been made.

Limits: Prospective improvements must be cost-effective — future savings must be more than the cost of improvements made. Cost-effective tests and a home energy assessment must be completed before qualifying.

Interest reduction programs for buyers

Mortgage payments are primarily made up of principal (the amount of money borrowed from a lender, not including interest or additional fees) and interest (the cost you pay to your lender for the amount borrowed, expressed as a percentage rate). Interest reduction programs can lessen the latter. You may qualify for a Mortgage Credit Certificate, which gives you a tax credit in interest paid or special financing at a reduced interest rate that lowers this cost.

Mortgage Credit Certificate

After a home purchase, state and local Housing Finance Agencies offer interest savings programs that allow qualified buyers with limited income to use a tax credit for a portion of their mortgage interest. The tax credit varies by state, but it typically ranges between 20 and 40 percent of your total mortgage interest. However, the IRS limits the credit to $2,000 per year. Still, you can claim the remainder of your mortgage interest as an itemized deduction. Please consult a tax professional to learn more about the tax implications of this Mortgage Credit Certificate program, which has been around since 1984.

Benefits: You can save on total interest payments.

Limits: The program can have costly application fees, and there are income and home purchase price restrictions. The IRS limitations make the credit less impactful in high-cost-of-living areas.

First-time home buyer loans

In 2022, just over half (58%) of first-time buyers said they put less than 20 percent down on their first home, while a little more than a quarter (28%) put down 5 percent or less. Many first-time home buyer loans allow for the flexibility to make a smaller down payment and still enjoy lower interest rates and other benefits.

FHA loan program

A Federal Housing Administration loan

can be an affordable option for first-time home buyers because the qualification requirements are typically not as strict as for other loan programs. FHA loans are insured by HUD’s Federal Housing Administration and are designed to encourage lenders to lend to borrowers who don’t have perfect credit or significant upfront cash. In March 2023, the government lowered the annual mortgage insurance premium for FHA borrowers, saving the average borrower of a median-priced, one-unit, single family home $800-$1,400 in their first year of homeownership.

Credit score requirements: 580 or higher (lower scores accepted with higher down payments)

Minimum down payment: 3.5%

Limits: Mortgage Insurance Premium is required for almost all FHA loans.

FHA Section 203(k)

A fixer-upper may be priced lower than a newer property, but affording the actual improvements is another challenge. That’s where the FHA Section 203(k) loan comes in.

Backed by the Federal Housing Association, this loan allows you to borrow funds to fix up a property that requires a lot of improvements. It’s not a solo loan product, though. In order to get the 203(k) loan, you must also be approved for an FHA loan. The 203(k) loan is then rolled into the FHA loan. There are loan amount restrictions as well: The 203(k) loan must be more than $5,000; the maximum is generally $35,000 (but can vary by county). You must also be able to afford a 3.5 percent down payment (at a minimum), though the down payment could be higher based on your credit score.

Limits: Though FHA loans have a lower down payment, there are some higher costs involved, such as costly mortgage insurance premiums, higher interest rates and a consultant inspection (paid for by the buyer). Also, if you are applying with a co-borrower, FHA considers the lowest median credit score between the two of you. Managing repairs to the home could be difficult and time-consuming.

USDA loan program

A U.S. Department of Agriculture (USDA) loan is an option for buyers looking for homes in approved rural locations, regardless of their intention to grow crops or raise livestock. USDA loans are great for first-time home buyers with limited income because they are fully guaranteed by the USDA, which lessens default concerns that lenders may have.

Credit score requirements: 640 or higher

Minimum down payment: Little or no money down

Limits: Strict eligibility based on income and location of home

VA loan program

A U.S. Department of Veterans Affairs (VA) loan is an option for U.S. military members, including veterans, active duty and their family members. VA loans are backed by the VA and representatives can help you through the process of acquiring the loan, or offer assistance if you are at risk of defaulting on your mortgage payments as a first-time homeowner.

Credit score requirements: No restriction

Minimum down payment: Funding fee only, can be rolled into the mortgage

Interest rate: Lower interest rates

Limits: Eligibility restrictions apply; the less you put down, the higher the VA funding fee will be.

Conventional loan program

Conventional loans are not backed by the government, and are instead offered by private lenders with their own eligibility requirements. In general, a conventional loan requires a credit score of 620 or higher, a down payment of 3% or more, and DTI around 45%. Your lender might have stricter requirements based on their review or your full financial profile. After closing, conventional loans are often purchased by investors who desire low-risk investments. Therefore, a conventional loan is a possible loan type for first-time buyers but they’re typically a less favorable option compared to FHA loans if you’re a first-time home buyer seeking financial assistance.

State and local programs

Depending on the state, county or city where you live, there may be first-time home buyer programs that offer benefits ranging from down payment assistance to low-interest mortgages. Many local programs also go by different names. Be sure to check local sites and work with a local lender to find opportunities for which you may qualify.

State programs

California: There are many first-time home buyer programs in California, including mortgages like the CalPLUS FHA Loan Program that can be combined with a zero-interest program for closing costs (CalHFA Zero Interest Program). If you need cash toward buying a home, the MyHome Assistance Program is a down payment assistance program that provides qualified first-time buyers with a small loan of approximately 3 percent of the purchase price of the home, depending on the loan type used for financing. The maximum loan amount is $11,000, but that limit is waived for some professions and home types. Repayment of the MyHome Assistance Program loan is deferred.

Florida: Through the Florida Housing Finance Corporation, first-time home buyers with a credit score of 640 and above may qualify for the Homebuyer Program, which offers a fixed-rate mortgage.

New York: The State of New York Mortgage Agency gives first-time home buyers access to low-interest and low-down-payment mortgages, in addition to down payment assistance programs. Achieving the Dream is the lowest interest-rate program that’s also flexible enough for the diverse housing stock in New York. Down payment requirements can be as low as 3 percent (a 3 percent down payment assistance forgivable loan is available). These mortgages can be used for one- to four-family homes, co-ops and condominiums.

Texas: The Texas State Affordable Housing Corporation has special programs for first-time home buyers along with home buyers who meet certain professional or income requirements. The Homes for Texas Heroes Home Loan Program offers a fixed interest rate loan with a down payment assistance grant or forgivable second-lien loan (of up to 5 percent) for those in helping professions (teachers, EMS personnel, firefighters, police officers, corrections officers, school nurses, school librarians, school counselors and veterans). First-time home buyers can also apply for a Mortgage Credit Certificate. The Homes Sweet Texas Home Loan Program offers similar benefits for low- and moderate-income buyers, but eligibility includes all professions (and it’s not limited to first-time home buyers).

Washington: Through the Washington State Housing Finance Commission, home buyers who meet income requirements can find programs that make homeownership affordable. The Home Advantage Program provides access to low-interest mortgages and can be combined with the Home Advantage Downpayment Assistance Program (between 4 and 5 percent of the purchase price, 0 percent interest and payment deferred for 30 years).

Missouri: Via the First Place Loan Program, qualified first-time home buyers can receive below-market interest rates that may be up to three-quarters of a percentage point lower than First Place loans that come with cash assistance.

Local programs

San Francisco, CA: The Mayor’s Office of Housing and Community Development has a few mortgage and down payment assistance programs for first-time home buyers in San Francisco. The Downpayment Assistance Loan Program is especially popular, offering up to $375,000 to bid on a property. The loan requires no payments for 30 years, or until the unit is sold. Once you apply for the loan, you will be assigned a lottery number. Your number determines when your application will be processed.

Jacksonville, FL: Through the Jacksonville Housing Finance Authority‘s First-Time Homebuyer Program, potential residents can get a fixed-rate, 30-year mortgage and a Mortgage Credit Certificate.

New York, NY: New York City does not have many first-time home buyer programs, but the State of New York Mortgage Agency‘s first-time home buyer programs can apply to homes in New York City. However, there is one popular New York City-specific program: The HomeFirst Down Payment Assistance Program. This gives first-time home buyers who meet certain income requirements a forgivable loan of up to $40,000 for down payment or closing costs.

Houston, TX: Houston’s Housing and Community Development Department offers two programs for first-time home buyers in the city. One is the Homebuyer Assistance Program, which offers up to $30,000 in down payment assistance in the form of a no-interest, forgivable loan to income-qualified buyers. The Harvey Homebuyer Assistance Program formerly offered the same, but it was intended for Houstonians who were in the city when Hurricane Harvey hit on August 25, 2017. Unfortunately, the Harvey Homebuyer Assistance Program stopped accepting applicants and is no longer funded to offer down payment assistance.

Seattle, WA: Seattle’s Office of Housing partners with local organizations to offer down payment assistance to first-time home buyers who are at or below 80 percent of the area median income. The amount of assistance and terms vary based on the type of home and the organization that administers the funds. In general, down payment assistance can be up to $55,000.

Loan programs for Native Americans

If you are Native American, there are a couple of specialized programs to help you purchase a home with a zero or low down payment. One program is for Native American veterans, and another is for American Indian and Alaska Native families.

Native American Direct Loan (NADL)

This loan option is for Native American veterans and their family members. You may qualify if you are a Native American enrolled in an American Indian tribe or Alaska Native village, a Pacific Islander or a Native Hawaiian. (Non-Native American veterans married to Native Americans may also qualify.) Funded by the VA, this program provides financing to buy, build or renovate homes on Federal Trust Land. If approved, there is no down payment required, no private mortgage insurance and low closing costs.

Credit score requirements: No specific score is listed, but applicants must have good credit.

Minimum down payment: There is no minimum down payment needed if approved for an NADL loan.

Limits: There are strict eligibility requirements to qualify for the NADL program. There must be a Memorandum of Understanding between your tribal government and the VA regarding the use of trust lands. In addition, you must have a VA home loan Certificate of Eligibility, meet credit standards and have proof of income for mortgage and homeownership costs.

Indian Home Loan Guarantee Program

Established by Congress in 1992, the Indian Home Loan Guarantee Program is available through the HUD Office of Native American Programs. This program offers loans with a low down payment option and flexible underwriting for American Indian and Alaska Native families, along with Alaska villages, tribes or tribally designated housing entities. (Native Hawaiians can qualify for Section 184A loans.) Section 184 loans can be used for homes on or off native lands, but not all states are eligible locations.

Credit score requirements: There is no minimum credit score for this program.

Minimum down payment: 2.25 percent

Limits: Loans must be made in an eligible area; not all states are eligible.